2 Financial Procedure Act 1957 3 Loan Local Act 1959 4 Government Finance Statistic Manual 5 Fiscal Policy Committee FPC PART III Annual Budget Preparation. Section 7 c of the Financial.

Non-applicability of section 14a of the Financial Procedure Act 1957 Pa r t Vii RELiEF REFUND AND REMissiON 56.

. Minister means the Minister charged with responsibility for finance. Financial Procedure Act 1957. Section 7 a of the Financial Procedure Act 1957 All types of money or revenue received except for loans and trusts are to be accounted for in the Consolidated Revenue Account Section 7 b of the Financial Procedure Act 1957 Consolidated Loan Account is established by the federal or the state government to keep all moneys received by way of loan.

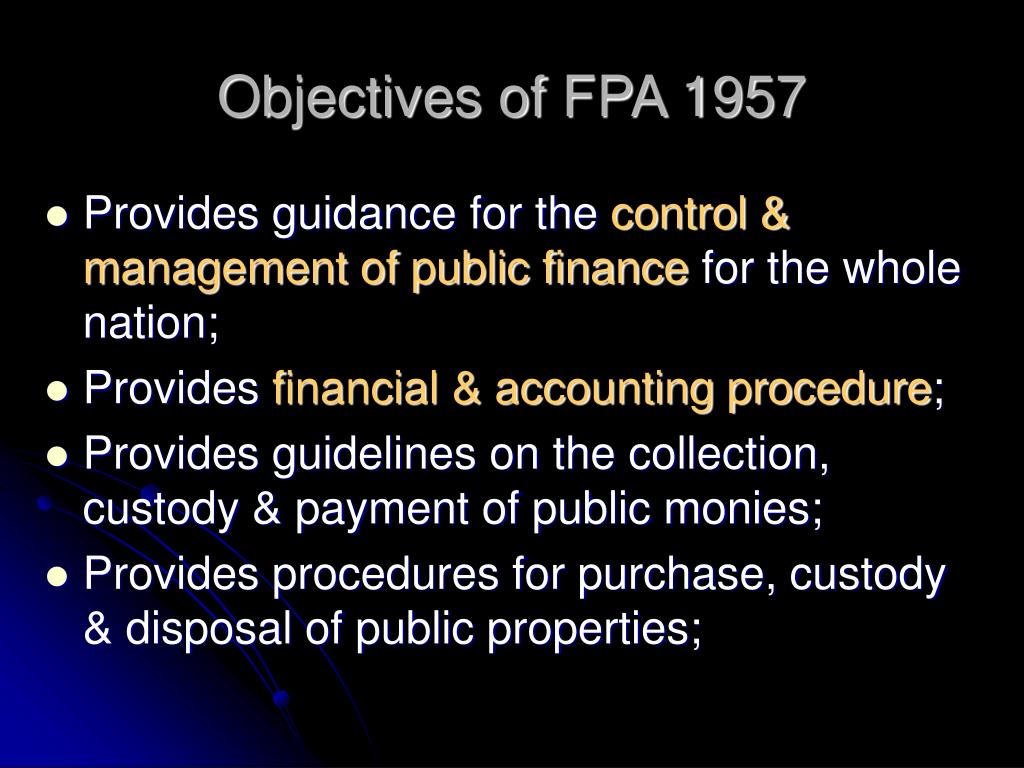

In accordance with the Financial Procedure Act 1957 Act 61 Treasury Instruction and the concept of Let Managers Manage the Controlling Officer is responsible for ensuring that all policies related to the expenditure are done carefully efficiently effectively have value for money and adhere to best practices so that financial management is controlled and transparent. An Act to provide for the control and management of the public finances of Singapore and for financial and accounting procedure including procedure for the collection custody and payment of the public moneys of Singapore and the purchase custody and disposal of public property of Singapore and for matters connected therewith. Act 61 FINANCIAL PROCEDURE ACT 1957 An Act to provide for the control and management of the public finances of Malaysia and for fi nancial and accounting procedure including procedure for the collec tion custody and payment of the public moneys of.

2 Clause 1 does not apply to any such sums as are mentioned in Clause 3 of Article 99. 3 No moneys shall be withdrawn from the Consolidated Fund except in the manner provided. Compensation for over-payment of tax PART VIII OFFENCES AND PENALTIES 112.

FINANCIAL PROCEDURE ACT 1957 Act 61. Unless expressly provided to the contrary by this Act no one shall be in any. State law means a any law enacted by Dewan Undangan Negeri or which the Dewan has the power to make.

Financial statements as regulated under Section 16 1 of the Financial Procedure Act 1957 Revised 1972. Budget Preparation Process 11 JANUARY FEBRUARY 2019 Guidelines for Proposed Budget. Relief for secondhand goods 60.

Amount expected to be received. 1 Subject to Clause 2 no moneys shall be withdrawn from the Consolidated fund unless they are -. This is known as Public Accounts.

Incorporating all amendments up to 1 January 2006 published by the Commisioner of Law Revision Malaysia under the authority of the revision of law act 1968. 6 Laws of Malaysia ACT 370 Saving 4. An Act to enable effect to be given to certain Conventions done at Geneva on 12 August 1949 and to a Protocol additional to those Conventions done at Geneva on 10 June 1977 and for related purposes.

An Act to provide for the control and management of the public finances of Malaysia and for financial and accounting procedure including procedure for the collection custody and payment of the public moneys of the Federation and of the States and the purchase custody and disposal of public property other than land of the Federation and of the States and for matters. Financial Procedure Act 1957 Objectives of Financial Procedure Act 1957 To provide guidance for the control and management of public finance To provide financial and accounting procedure To provide guidelines on the collection custody and payment of public monies To provide the procedures for purchase custody and disposal of public properties To provide the authority for. Financial Procedure Act 1957 and any regulations made and instructions issued thereunder shall apply to the Director and other persons in the service of the Water Department.

Non applicability of section 14A of the Financial Procedure Act 1957 111 D. The Financial Procedure Act 1957 Act 61 which is referred to as the principal Act in this Act is amended by substituting for the words public stores wherever appearing the words. Power of Minister to grant relief 57.

Amount actually received spent during the year. Tourist Refund scheme 62. Statement of Consolidated Revenue Account showing purposes subdivisions of the.

Companies Act 1965 Act 125. Recovery of tax etc erroneously refunded 61. C authorised to be issued under Article 102.

Bad debt relief 59. Failure to furnish country-by-country report 113. It includes procedures for the collection custody and payment of the public monies of Malaysia and of.

Percetakan Nasional Berhad 2006 Description. 1 This Act may be cited as the Financial Procedure Act 1957. The Federal Public Accounts contain the Balance Sheet Statement of Cash Receipts and Payments Statement of Memorandum Accounts and notes to the Accounts.

Incorrect returns information returns or reports 114. Refund of tax etc overpaid or erroneously paid 58. Failure to furnish return or give notice of chargeability 112A.

2 This Act shall not apply to the Railway Administration established under the Railway Ordinance 1948 MU. The Balance Sheet comprises of a Statement of Cash. Part I Preliminary.

2 The Fund shall be administered by the Pensions Trust Fund Council. 102550 substituted section 1956 of this title for section 5312 of title 31 and inserted including any transaction that would be a financial transaction under section 1956c4B of this title before but such term does not include. 8 of1948 nor to any person in the service of that Administration.

Into the Second Schedule to the Financial Procedure Act 1957 Act 61. Yearly statement of accounts Section 16 Section 9 of the Audit Act 1957 requires the financial authority of Federal State at the end of each financial year to prepare. Pensions Trust Fund Council 4.

1 Short title This Act may be cited as the Geneva Conventions Act 1957. And For Reference Only Footer Page 7 of 24. State Financial Authority shall have the same meaning as assigned to that expression in the Financial Procedure Act 1957 Act 61.

Deleted by Act A722. 42 FINANCIAL PROCEDURE ACT 1957 Revised 1972 The Financial Procedure Act 1957 Revised 1972 provides for the control and management of the public finances of Malaysia and outlines financial and accounting procedures. 3 The Accountant General Malaysia shall be responsible for the day to day administration and management of the affairs of the Fund.

Pad370 Financial Procedure Act 1957 Act 61 Laws Of Malaysia Reprint Published By The Studocu

Financial Procedure Act 1957 Gabrieltrf

Financial Procedure Act 1957 Gabrieltrf

Pdf Accrual Accounting In Government Is Fund Accounting Still Relevant

Financial Procedure Act 1957 Gabrieltrf

Ppt Chapter8 Budget Important Techniques Process Powerpoint Presentation Id 4733580

Pdf Internal Audit Practice In Malaysian Public Sector Organizations Semantic Scholar

Framing Public Governance In Malaysia Rhetorical Appeals Through Accrual Accounting Sciencedirect

Financial Procedure Act 1957 Gabrieltrf

Pad190 Principles Of Public Administration Ppt Download

Ppt Financial Accounting Reporting Powerpoint Presentation Free Download Id 4757945

Financial Procedure Act 1957 Gabrieltrf

Financial Procedure Act 1957 Gabrieltrf

Financial Procedure Act 1957 Gabrieltrf

Changing Senate Rules Or Procedures The Constitutional Or Nuclear Option Everycrsreport Com